Climate change and the ensuing impact on the Environmental Liability of businesses is getting impossible to overlook. It is no longer just loss of sea ice and sea levels rising, things that feel easier to ignore when they are not close to home, now we are seeing more widespread effects in our day-to-day lives – there are more intense heat waves, droughts, earthquakes, wildfires and extreme rainfall seen across the globe.

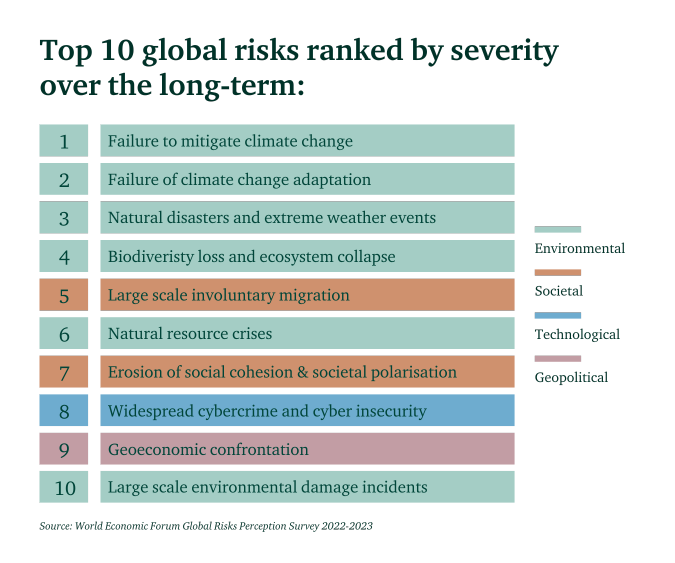

Situations such as the record temperatures experienced in the UK and Europe in 2022 are quickly encouraging businesses to prioritise these issues. This has been reflected in the World Economic Forum findings that show extreme weather events, climate change, human-made environmental disasters, biodiversity loss and natural disasters are now in the top 10 risks that are of concern to businesses at board level. With failute to mitigate climate, failure of climate chnage adaptation and extreme weather events identified as the top 3 global risks by severity.

As climate change is not attributable to single sources and single company operations, the effects on a business are (generally) not insured under existing Environmental Impairment Liability (EIL) programmes. Climate change though, does cause extreme weather events which tend to increase the severity and frequency of pollution incidents. And these incidents, particularly ground and water pollution, can be directly attributable to a single business operation or activities. Pair this with the general public’s heightened awareness of climate and pollution issues and the lowering of their threshold for acceptance of such incidents and an environmental issue can soon become a reputational one too. So now, as a business, your concern isn’t ‘just’ fixing the damage caused to the environment but considering how to mitigate any brand and reputational damage that could ensue.

The most common claims according to some insurers are those for the cost of preventive and remediation measures for on-site and off-site environmental damage. The amounts of the claims range widely but easily reach multimillions when you consider ongoing replacement and monitoring costs.

There is a common misconception that your General Liability policy will cover you in these ‘less than likely’ events but the chances are it won’t and the costs can very quickly mount up. This is where your Environmental Impairment Liability (EIL) policy proves it worth.

An EIL policy is not there to prevent the incident in the first place, little can be done about the weather, but it does provide you with access to environmental legal, consulting and claims experts to help protect your balance sheet and your reputation while providing invaluable support in an emergency response situation.

As more incidents occur we see more EIL policies cropping up, and while more choice is good thing it also makes it increasingly more difficult to not just understand the coverage you need, but to know which policy is right for you. Team this with market movements such as US capacity reducing and the London market seeing new entrants and general recalibration of appetites, the landscape is ever-changing and challenging to navigate.

That’s why at McGill and Partners we have invested in the finest specialist Environmental brokers in the market to ensure we provide our clients with the best possible service from the first discussions to the point of claim, the time when it’s needed the most. We have the ability to access over $400M of capacity and can offer key products such as Contractor’s Pollution Liability for contracting risk, and Premises products that can include Historic Pollution Liability, Sudden and Accidental only or Full Pollution including Gradual, Primary or Excess to General Liability.

We will always work with you to understand your requirements and then tailor a bespoke policy to best suit your business needs and existing insurances, regardless of how complex.